Read

Edit

History

Notify

Share

Avitus

Avitus is a decentralized exchange built on the Movement Chain, offering perpetual trading with advanced tools and infrastructure. It provides features like high leverage, automated trading bots, and risk management mechanisms for traders and liquidity providers. [1]

Overview

Avitus is a decentralized exchange (DEX) on the Movement Chain. It utilizes a high-performance network capable of processing 160,000 transactions per second with low fees and near-instant finality. It enables self-hedging, automated market-making, 100x leverage, and automated trading bots. Its self-hedging liquidity pool reduces risk for liquidity providers while offering returns through dynamic fee-sharing mechanisms, and traders have access to tools such as liquidity heatmaps, oracle deviation protection, and Telegram-based trading apps. Avitus plans to expand its offerings with additional assets and financial products, prioritizing scalability, security, and transparency. [2]

Avitus V1

AvitusV1 is the initial implementation of the Avitus protocol. It is designed to provide advanced trading tools, innovative liquidity solutions, and a streamlined user experience for perpetual trading. The protocol incorporates proprietary mechanisms to enhance capital efficiency, mitigate risk, and optimize trading processes. The Self-Hedging Automated Market Making (SHAMM) mechanism minimizes risks for liquidity providers (LPs) by efficiently utilizing their capital while offering high APRs. This system also reduces exposure to impermanent loss and slippage, enabling seamless and effective trades. Traders can leverage positions up to 100x on top assets, capitalizing on market movements with high-speed execution.

AvitusV1 integrates advanced tools like liquidity heatmaps and price deviation protection. Liquidity heatmaps and deep ticker trackers provide insights into market zones and price movements, supporting strategic trading decisions. Price deviation protection allows traders to set custom ranges for executing trades during volatile conditions, ensuring reliability in dynamic markets. Automated trading is supported through two types of customizable bots: closed-form bots with pre-programmed strategies and decision-tree bots for user-defined tactics. These bots are accessible via the platform or a Telegram mini-app, offering convenience and trading on the go. The fee structure includes 6 BPS for manual trades and 8 BPS for bot trades, with most fees redistributed to LPs to foster liquidity and growth.

Staking Avitus tokens unlocks features such as enhanced bots, trading events, governance participation, and up to 8% APR. Built on the Movement Chain, AvitusV1 benefits from a high-performance infrastructure capable of 160,000 transactions per second, low fees, and parallel execution for scalability. For traders, AvitusV1 offers high leverage, advanced trading tools, gasless transactions, and automated bots for passive or active trading strategies. It ensures superior capital protection, transparent fee-sharing, and significant rewards for liquidity providers, creating a robust and user-focused ecosystem. [3]

Features

Price Deviation Protection

Price Deviation Protection mitigates risks associated with rapid price fluctuations in volatile markets. Traders can define a deviation range to account for minor price changes, allowing trades to execute smoothly within this range. This feature reduces transaction failures caused by oracle delays or sudden market movements, ensuring more reliable and uninterrupted trading. [4]

Autobots

Avitus provides automated trading bots, called Autobots, to streamline trading and enhance strategy execution. These include Closed-Form Bots, which operate autonomously using preprogrammed logic, and Decision-Tree Bots, which allow users to customize inputs and strategies. Access to advanced bots is determined by a stake-to-access model, where staking more Avitus tokens unlocks higher-tier bots. These tools enable efficient, precise execution of trading strategies, minimizing the need for active monitoring and reducing human error. [4]

Telegram Mini-App Bots

Avitus offers a Telegram Mini-App for convenient trading on the go. This feature enables users to execute trades and access Autobots directly within Telegram, providing seamless market connectivity without requiring a desktop setup. It is particularly useful for maintaining trading activities while traveling or away from traditional devices. [4]

High Leverage Trading

Avitus supports high-leverage trading, allowing users to amplify their market exposure with up to 100x leverage on major assets. This feature enables traders to control significantly larger positions with minimal capital, catering to those pursuing aggressive strategies or institutional-scale trading. While it increases profit potential, it also heightens risk, requiring careful management to avoid substantial losses. [4]

Insight Tools

Avitus offers advanced insights tools designed to support strategic trading. Liquidity heatmaps highlight areas of high liquidity, helping traders anticipate potential price movements caused by concentrated market activity. The deep ticker tracker delivers detailed market data, including risk zones and liquidity trends, enabling users to better understand market dynamics and refine their trading strategies. [4]

Clearinghouse

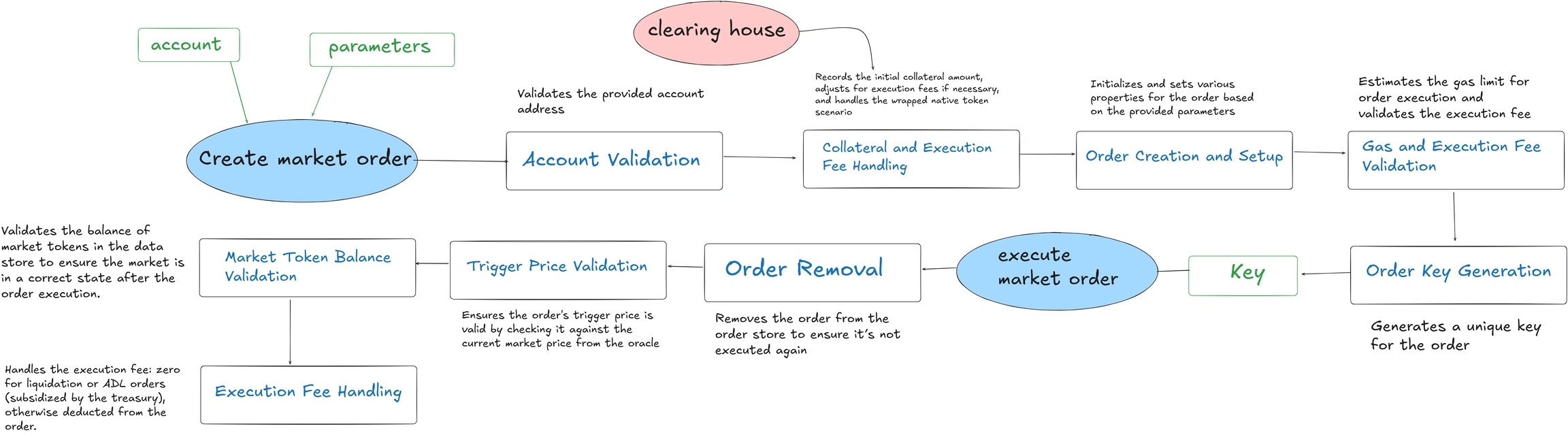

The Avitus Clearinghouse is the core operational framework of the AvitusV1 protocol, responsible for managing user balances, positions, and risks within the ecosystem. It ensures accurate position tracking, profit and loss (PnL) calculations, and seamless integration with other system components, forming the backbone of the perpetual trading platform.

The Clearinghouse enforces margin requirements through Cross-Margin and Isolated Margin modes, accommodating diverse trading strategies. It manages user positions, providing real-time updates to balances and PnL as market conditions fluctuate. It also handles the lifecycle of trades, including liquidation, when positions fall below the Minimum Margin Ratio (MMR).

PnL is calculated using mark-to-market settlement, valuing positions based on real-time market prices. Traders can opt for One-Way positions to maintain a single net position or Hedged positions to hold simultaneous long and short positions in the same market. This framework ensures precision, scalability, and reliability across the AvitusV1 ecosystem. [5]

Margin Allocation

The Clearinghouse provides two margin allocation modes to accommodate varying trading strategies: [5]

- Cross-Margin Mode pools all deposited collateral into a unified balance that supports multiple open positions. This approach allows efficient capital use, as losses in one position can be offset by margin from others, reducing the likelihood of liquidation. It is suited for traders managing multiple positions who aim to optimize their available capital.- Isolated Margin Mode assigns a specific margin to each individual position, keeping the margin for different positions independent. Losses in one position do not affect others, allowing for precise risk management. This mode is ideal for traders focused on controlling risk for specific trades or employing targeted hedging strategies.

Positions

The Clearinghouse offers flexibility with two trading modes: One-Way and Hedged, catering to different strategies: [5]

- One-Way Mode maintains a single net position per market, simplifying management by combining opposing trades. For instance, opening both long and short positions in BTC/USD results in a single net position reflecting the size and direction of the trades. This mode suits traders focused on straightforward directional strategies.- Hedged Mode allows simultaneous long and short positions within the same market, each managed independently. This approach supports advanced strategies, such as arbitrage or market-neutral trades, providing greater control for experienced traders.

AVTS

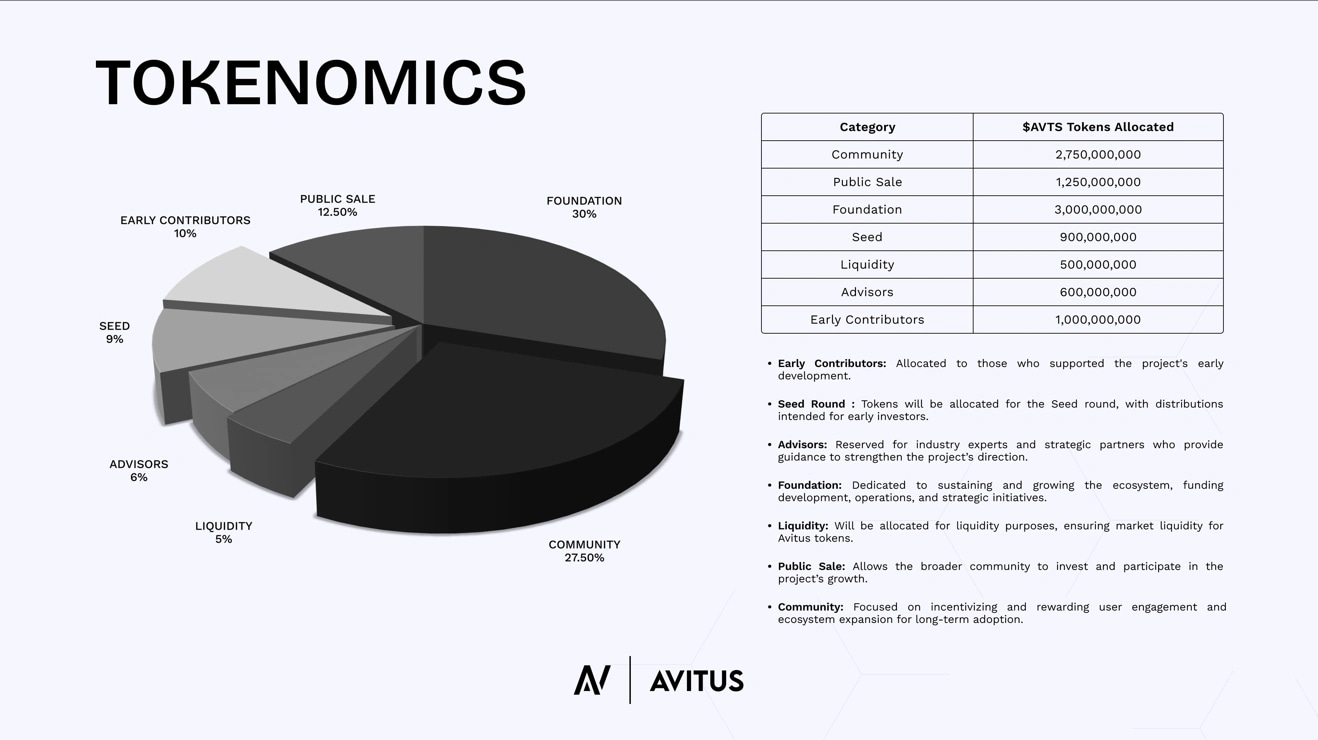

AVTS is the native token of Avitus. It has a max supply of 10B tokens and has the following distribution: [6]

- Foundation: 30%- Community: 27.5%- Public Sale: 12.5%- Early Contributors: 10%- Seed: 9%- Advisors: 6%- Liquidity: 5%

Partnerships

- Milkyway

- WarpGate

- Henry

- Gogopc

- Xebra Trade

- BRKT

- Yuzu

- Move Wiff Frens

- Lunch

- Arkai

- Halo

- Moon Moverz

Avitus

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]