Read

Edit

History

Notify

Share

Jeff Yan

Jeff Yan is the CEO and co-founder of Hyperliquid, a decentralized exchange built on its own Layer-1 blockchain. With a background in computer science and experience in market making, he transitioned from traditional finance to the crypto space, focusing on innovative trading solutions and decentralized finance. [2] [4]

Education

Yan graduated from Harvard University with an AB/SM in Mathematics and Computer Science in 2017. [1]

Career

After graduating, Yan joined Hudson River Trading, a prominent market maker in U.S. equities, where he gained valuable experience working on complex problems, blending engineering and mathematics. In 2018, driven by the rise of cryptocurrency and Ethereum, he left to develop an L2 exchange protocol as a prediction market. Despite raising funds and moving to San Francisco to build a team, the project was eventually shut down due to regulatory uncertainties and a lack of user adoption, as most people were more interested in token speculation than decentralized finance.

After this, Yan returned to trading, initially focusing on crypto as a side project. However, he quickly recognized the inefficiencies in the market and scaled his efforts rapidly. By early 2020, he had grown with the market, and his team became one of the largest market makers on centralized exchanges. About a year ago, Yan turned his attention to DeFi trading, observing inefficiencies in the protocols and growing demand for decentralized products following the FTX incident. This led him to shift his focus to building Hyperliquid while maintaining his HFT operations on autopilot in the background. [1] [3]

Hyperliquid

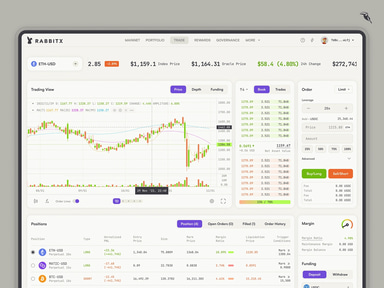

In an interview with Blocmates, Yan discussed Hyperliquid, a decentralized exchange (DEX) he and his team developed after recognizing inefficiencies in the decentralized finance (DeFi) space. The team originally operated as a crypto market-making firm on centralized exchanges since the 2020 bull run, successfully executing high-volume strategies. By late 2022, they began exploring DeFi and were surprised by the flaws in many existing protocols, particularly their exploitable market structures. Realizing that despite these flaws, there was significant demand for DeFi platforms, they decided to create a fully decentralized exchange that could match centralized exchanges' performance and user experience. To achieve this, they built their own Layer 1 (L1) blockchain that supports a fully on-chain order book, avoiding the limitations of Layer 2 (L2) solutions like Arbitrum, which they found too costly for high-frequency market-making. The Hyperliquid L1 is designed to provide fast, low-latency trades while keeping users in control of their funds with full transparency. Yan emphasized that Hyperliquid's goal is to merge the best aspects of centralized and decentralized exchanges, offering a seamless user experience with the security and autonomy of DeFi. [5]

Interviews

Winning in Crypto

Yan shared insights into developing Hyperliquid’s decentralized platform to disrupt traditional finance systems on the When Shift Happens podcast. His journey began with experimenting in crypto trading, eventually realizing the potential for decentralized finance (DeFi) after centralized exchanges like FTX collapsed. Hyperliquid, which provides a user-centric platform, avoids typical startup approaches like raising funds from VCs or incentivizing market makers. Instead, the team prioritizes creating a product that users love, building from first principles. Despite the challenges and risks, Yan is committed to pushing DeFi forward, believing that offering better user experience and truly decentralized systems is the path toward real market change. [6]

Better Perp DEX

On the 0xResearch podcast, Yan discussed the development of Hyperliquid’s decentralized perpetual exchange (perp DEX) and the company’s expansion into launching a Layer 1 (L1) blockchain. Initially focused on building a successful perp DEX with a strong user base, Hyperliquid leveraged its team's background in quantitative trading and low-level infrastructure to solve technical challenges such as liquidity and slippage, ensuring a competitive edge over centralized exchanges. Yan explained that the L1, initially built to support their DEX, now serves as a broader infrastructure for financial ecosystems, attracting users and liquidity. He emphasized the importance of custom-built solutions like the Vault system, which allows users to create decentralized copy-trading strategies. While initially not part of the plan, Hyperliquid's pivot to an L1 was influenced by the realization that existing decentralized platforms were insufficient, particularly following the collapse of FTX. This shift allowed them to create a platform capable of scaling decentralized finance to match traditional finance. [7]

Panels

DEXplosion

At TOKEN2049 Singapore 2023, several DEX founders discussed the growth and challenges of DEXs post-FTX. Yan, Cindy Leo from Drift, Julian Koh from Ribbon Finance, and Suyang Yang from Circuit shared insights into their platforms and the broader DEX landscape. They identified liquidity as a major barrier for DEXs to compete with centralized exchanges (CEXs), noting that liquidity must significantly improve for DEXs to attract institutional traders and power users. They also highlighted challenges such as long onboarding times, the need for smoother user experiences, and the importance of censorship resistance and transparency in the decentralized space. The founders emphasized that despite these hurdles, DEXs offer key advantages like better privacy, community ownership, and security. They also discussed technical decisions, such as building on custom layer-1 or layer-2 solutions to avoid congestion and maintain performance during market volatility. [8]

Jeff Yan

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

Experience: Hudson River Trading · Education: Harvard College · Location: United States · 180 connections on LinkedIn. View Jeffrey Yan’s profile on LinkedIn, a professional community of 1 billion members.

Mar 17, 2025

[2]

Hyperliquid is the blockchain to house all finance. For the first time, build projects, create value, and exchange assets on the same hyper-performant chain.

Mar 17, 2025

[3]

[4]

[5]

[6]

[7]

[8]