Read

Edit

History

Notify

Share

M2 Exchange

M2 Exchange is a cryptocurrency trading platform (CEx) based in the United Arab Emirates. It is regulated by the Financial Services Regulatory Authority (FSRA) within the Abu Dhabi Global Market (ADGM). Established in 2023, M2 Exchange operates with a focus on providing a secure and compliant environment for trading a variety of virtual assets. The platform serves retail and institutional investors in over 150 countries.[5][6][7]

Overview

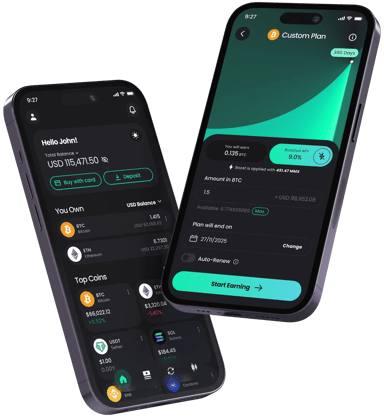

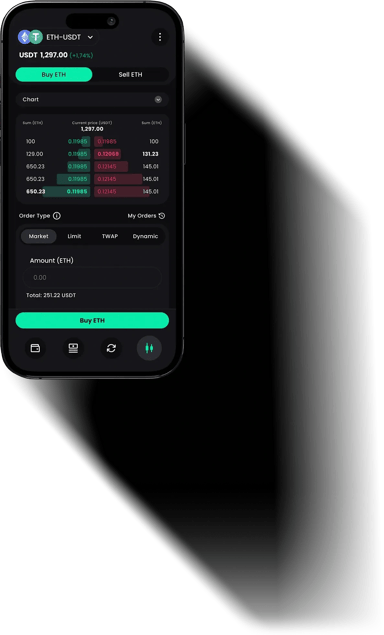

M2 Exchange offers a range of trading and financial products designed to meet the needs of both new and experienced traders. The platform supports spot trading, perpetual futures contracts, and staking services across more than 50 verified digital assets, including Bitcoin (BTC) and Ethereum (ETH). Users have access to advanced order types and trading tools, such as Time-Weighted Average Price (TWAP) orders, dynamic market orders, and real-time transaction monitoring.

The platform's interface is designed to be user-friendly while incorporating security measures. M2 adheres to international regulations, including anti-money laundering (AML) and Know Your Customer (KYC) requirements, which are fundamental for asset protection and fraud prevention. Regular external audits are conducted to verify the platform's financial and operational integrity. Security measures include cold storage for the majority of user funds and multi-factor authentication for account access.[5][6][7]

MMX Token

The M2 Exchange ecosystem includes its native utility token, $MMX, an ERC-20 token on the Ethereum blockchain. With a total supply of 500 million tokens, MMX offers benefits such as reduced trading fees, higher yields on staking, and early access to new listings and platform features. The MMX token employs a deflationary model through a token burn mechanism that reduces the circulating supply over time. MMX holders can also stake their tokens to increase their rewards.

MMX is part of the platform’s governance structure, allowing token holders to participate in decision-making processes related to the exchange's future. This feature aligns with trends in the cryptocurrency industry that emphasize community involvement in platform governance.[1][4][6]

Tokenomics

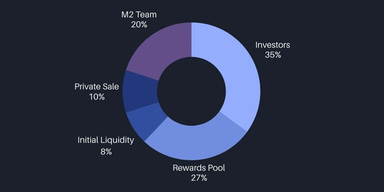

Distribution

Investors:

- Percentage: 35%

- Token Supply: 175,000,000

- Vesting Terms: Locked for 2 years, followed by a monthly release over the subsequent 3 years.

Rewards Pool:

- Percentage: 27%

- Token Supply: 135,000,000

- Vesting Terms: Initially locked, with 10% of tokens unlocked every month.

Initial Liquidity:

- Percentage: 8%

- Token Supply: 40,000,000

- Vesting Terms: Fully unlocked at launch.

Private Sale:

- Percentage: 10%

- Token Supply: 50,000,000

- Vesting Terms: 20% of tokens released immediately, with a 3.333% linear release every month for 2 years, starting from month 12.

M2 Team:

- Percentage: 20%

- Token Supply: 100,000,000

- Vesting Terms: Locked for 2 years, with a monthly release over the subsequent 3 years.

This distribution model aims to balance immediate liquidity needs with long-term commitment, ensuring that the token supply aligns with the platform’s growth and stability objectives.[1][4][6]

Key Features

-

Earn Products: M2 offers earning products that enable users to generate income from their digital assets. The platform supports both flexible and fixed-term staking plans, with durations ranging from 30 to 360 days. These plans cover over 30 different cryptocurrencies and offer competitive annual percentage yields (APYs). Users staking MMX tokens within these products can receive enhanced returns.

-

Advanced Trading Tools: M2 Exchange provides advanced trading tools, including TWAP (Time-Weighted Average Price) orders and dynamic market orders. These tools help users optimize their trades by executing large trades over time or adjusting orders in response to market conditions. The platform also offers real-time transaction monitoring, order book visualization, and market depth analysis.

-

Institutional Services: M2 Exchange caters to institutional clients through its over-the-counter (OTC) trading desk and virtual asset management services. These services offer deep liquidity, competitive pricing, and customized solutions for high-net-worth individuals and institutional investors. The OTC desk facilitates large volume trades with minimal slippage, while the asset management service assists institutional clients in managing diversified cryptocurrency portfolios.[3][1][6][7]

Security and Compliance

Security is a primary focus of M2 Exchange. The platform uses cold storage solutions to secure the majority of client funds, and employs multi-factor authentication (MFA) and advanced encryption technologies for account and data protection. M2 complies with the regulatory framework set by the FSRA, including AML/KYC measures, to prevent illicit activities such as money laundering and fraud. The platform undergoes regular external audits to verify financial and operational security, reinforcing transparency and trust among users.[3]

M2 Exchange

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]