Read

Edit

History

Notify

Share

Mantra

MANTRA Chain is a permissionless blockchain designed for developers and institutions to build and launch compliant Web3 financial applications. Utilizing the Cosmos SDK offers a secure and transparent platform for tokenizing, investing in, and trading real-world assets. John Patrick Mullin, Rodrigo Quan Miranda, and Will Corkin are MANTRA's co-founders. [1]

Overview

MANTRA Chain is a Layer 1 blockchain designed to tokenize real-world assets (RWAs). It is a permissionless blockchain for permissioned applications, capable of adhering to and enforcing real-world regulatory requirements. Built specifically for RWAs, MANTRA Chain provides a compliant environment for users, developers, and regulators to operate, supporting global RWA liquidity. [2]

MANTRA aims to create a highly liquid RWA ecosystem of permissioned dApps, where users undergo KYC to trade regulated products on a permissionless chain accessible to anyone. It offers advanced functionalities unavailable in typical non-custodial decentralized exchanges (DEX), including trading various crypto, real estate, and equities assets and integrating directly with traditional banking systems for seamless interaction between crypto and fiat or on-chain. MANTRA's ecosystem, comprising the blockchain protocol and exchange platform, allows for single-click transfers from bank accounts to brokerage to wallets, abstracting away the frictions between on and off-chain worlds. [2]

Features

MANTRA Compliance

MANTRA Compliance offers tools and services to help Web3 platforms meet regulatory requirements for cryptocurrency transactions and financial activities. It streamlines and automates regulatory compliance, enabling Web3 businesses to participate safely in the cryptocurrency and blockchain economy. [3]

Features of MANTRA Compliance include: [3]

- KYC/KYB Protocols: User and business verification, wallet address verification, sanctions/adverse media lists, and AML screening.

- Reusable KYC: Digital identity (DID) and soulbound NFTs.

- Ongoing AML Checks: Continuous user profile monitoring.

- User Risk Scoring: Assessing user risk levels.

- Transaction Monitoring: Know Your Transaction (KYT) protocols.

Built on MANTRA Chain's blockchain platform, MANTRA Compliance allows real-time and transparent tracking of transactions and financial activities. It helps businesses detect and prevent fraudulent or illicit activity and reduce regulatory non-compliance risks. [3]

On-Chain Decentralized ID (DID)

As part of MANTRA Compliance, the On-chain Decentralized ID (DID) system provides a secure, efficient, and reusable method for verifying individual identities for regulatory KYC/AML purposes. After verification, MANTRA Compliance issues a Soulbound NFT/ID—a unique, non-fungible token tied to the user's ID. This token serves as proof of identity and can be used for KYC verification with third parties, ensuring the user's personal information is not duplicated and is only stored once, streamlining the KYC process. [3]

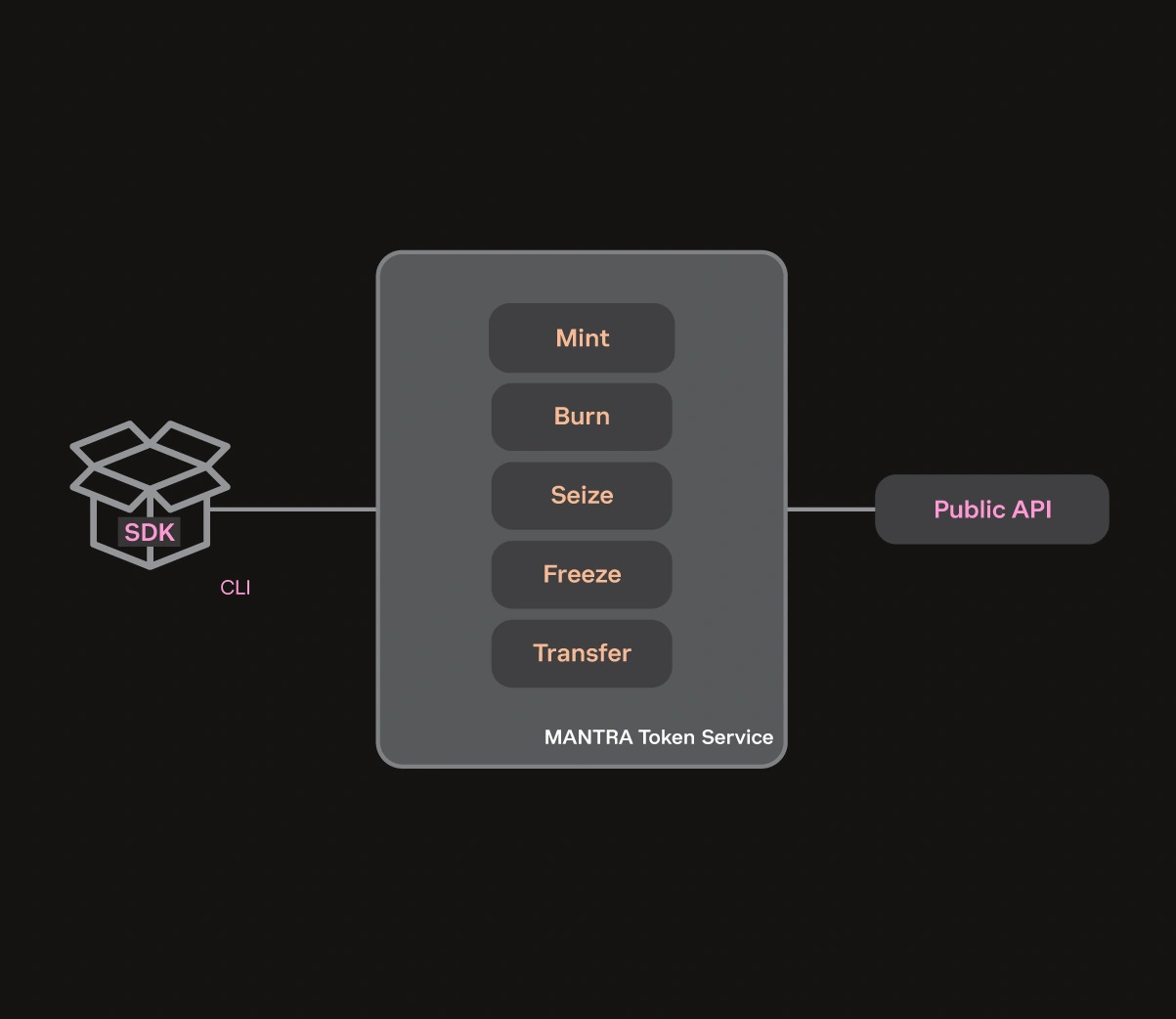

MANTRA Token Service

MANTRA Token Service (MTS) is an SDK (Golang + NodeJS) that enables Web3 businesses to create, issue, distribute, and manage digital assets on the MANTRA network. A key feature of MTS is its ability to create digital assets that are compliant with various regulatory frameworks, such as those for fiat currencies, securities, commodities, or other financial instruments, facilitating the creation and trading of regulated assets across different jurisdictions. MTS operates on a permissioned model, allowing only approved entities to create, manage, or transfer tokens, ensuring responsible use and compliance with relevant laws and regulations. [4]

Other features of MTS include: [4]

- Asset Management: Create, issue, and manage fungible and non-fungible assets.

- Access Control/Permissions Layer: Provides role-based access control, including the ability to freeze, seize, destroy, and transfer tokens.

- Configurable Yield and Royalties: Customizable options for yield and royalties.

- Predictable and Low Fees: Ensures cost-effective transactions.

MANTRA Assets

MANTRA Assets is a dApp that utilizes the MANTRA Token Service SDK, enabling entities to issue security tokens on the network. It provides businesses, organizations, and individuals a platform to launch security tokens representing real-world assets such as securities or other financial instruments. [5]

With MANTRA Assets, entities can define the characteristics of their tokens, including name, symbol, the number of tokens to be issued, and amounts of yield or royalties. The dApp offers various tools to help entities manage their security tokens, including tracking ownership, granting or revoking permissions, and transferring tokens. Additionally, MANTRA Assets can automate processes like distributing dividends to token holders. [5]

MANTRA DEX

MANTRA DEX is a DeFi hub utilizing the Cosmos ecosystem to facilitate efficient and secure real-world asset trading. The platform aims to provide investors a fast and effective way to trade real-world assets and capitalize on opportunities in traditional finance (TradFi) and decentralized finance (DeFi). Key features of the MANTRA DEX include: [6]

- Automated Market Making (AMM): Utilizes AMM technology for fair and efficient trading of real-world assets.

- Liquidity Provision/Farming: Incentivizes liquidity providers, ensuring deeper and more competitive order books.

- Order Book: Offers a transparent order book for efficient price discovery and trade execution (planned for future implementation).

- Cross-Chain Compatibility: Leverages the Cosmos ecosystem for trading assets across multiple blockchain networks via Cosmos IBC integration.

- High Speed and Low Latency: Ensures a seamless trading experience.

- Easy-to-Use Interface: Features a user-friendly interface for easy navigation and trading.

- Staking Rewards: Allows users to earn rewards through a staking program.

- Asset Tokenization: Integrates with the MANTRA Token Service.

- Dynamic Fees: Uses dynamic fees to reduce trade costs based on market conditions, providing a sustainable ecosystem for liquidity providers.

Hongbai

Hongbai is the testnet for all changes and updates to MANTRA Chain’s infrastructure before they are deployed to the mainnet. It provides a comprehensive environment for developers to experiment with account creation, token transfers, development tools, and smart contract deployment. Hongbai closely mirrors the behavior of the mainnet, allowing developers to test their applications in conditions similar to those on the live network. By simulating real-world scenarios, Hongbai helps developers identify and address potential issues or bugs before they affect mainnet users. [7]

The Hongbai Testnet is a distributed network of nodes that validate and propagate transactions through a decentralized protocol, ensuring seamless data exchange. Using a Proof of Stake (PoS) consensus mechanism, validators validate transactions and propose new blocks, maintaining the network's integrity and security. [7]

Key developments of the Hongbai Testnet include: [7]

- Native Token Adoption: OM is the native token of the testnet, reflecting community consensus and solidifying its role within the ecosystem.

- Account Creation and Testnet Token Transfers: Users can create accounts, generate cryptographic key pairs for authentication, and simulate the transfer of digital assets between accounts to test the tokenization and transfer of RWAs within the MANTRA ecosystem.

- Developer Onboarding: Developers can access tools like CosmWasm for smart contract development and deployment, enabling innovation and ease of creating new dApps.

- Proprietary Modules: Custom modules for RWAs, such as Compliance, Token Service, and Guard, enhance security, asset management, and user interactions within the ecosystem.

- User-Friendly UI: An intuitive interface simplifies interactions with the MANTRA Chain, streamlining the development and deployment process for developers.

- Phased Validator Onboarding: A phased approach to validator onboarding maintains network security and performance by gradually introducing a curated set of validators.

- Community Engagement: The testnet promotes community engagement through various activities and incentives, encouraging active participation and shaping the platform's future direction.

OM Token

$OM is the mainnet coin of the MANTRA Chain, allowing users to participate in a regulatory-compliant RWA ecosystem and earn rewards by delegating to validators who secure the network. As a Proof of Stake (PoS) mainnet coin, $OM enables users to secure the RWA Layer 1 blockchain and influence future $OM liquidity emissions in exchange for a staking yield. The genesis $OM token supply will be uncapped with variable inflation upon mainnet launch, ensuring a robust PoS network with continual validator incentives. [2][8]

The MANTRA Layer 1 blockchain employs a PoS mechanism where the OM token secures the network. Validators and delegators can stake and earn rewards. MANTRA operates under community governance, allowing the community to propose and decide on important matters such as chain upgrades and protocol integrations. [2][8]

When a new token is minted or burnt within the Guard Module, fees are paid to the protocol treasury. After completing KYC, users receive $OM, which is stakeable to access the Guard Module. In this module, the dApps stake is used to deploy, and the users' stake is used to access dApps. [2][8]

Tokenomics

MANTRA Chain's launch will involve creating new OM tokens to incentivize community participation, support staking, and finance ecosystem development. An additional 888,888,888 OM tokens will be minted, supplementing the existing 888,888,888 OM tokens. These new tokens will be allocated at MANTRA Chain's genesis. Additionally, there will be an elastic issuance of new OM tokens to address the increasing complexity of OM as a chain token. Over time, OM inflation will be reduced, transitioning to real yield staking once the RWA ecosystem is sufficiently developed. [9]

Partnerships

- Allnodes

- Chainlink

- Cosmostation

- HexTrust

- Imperator

- Informal Systems

- Interchain Foundation

- Keplr

- Leap

- LimeChain

- Lumia (ORN)

- Ondo

- RWA Inc

- Skip

- Stride

- SwissBorg

- Trust

- Zoth

- Zand [10]

Investors

In March 2024, MANTRA announced a successful $11M funding round led by Shorooq Partners. Other investors included Three Point Capital, Forte Securities, Caladan, Virtuzone, Hex Trust, Token Bay Capital, GameFi Ventures, Mapleblock, Fust Capital, 280 Capital, and others. [11]

Developments

Mantra Launches $108M Fund

On April 7, 2025, Mantra blockchain network launched a $108,888,888 ecosystem fund aimed at accelerating the growth of startups focused on real-world asset (RWA) tokenization and decentralized finance (DeFi), amid rising demand for stable, asset-backed digital products. [12]

Mantra said it will deploy the capital over the next four years among “high-potential blockchain projects” worldwide, with investment opportunities sourced through Mantra’s network of partners.

The fund’s backers include a wide range of partners including Laser Digital, Shorooq, Brevan Howard Digital, Valor Capital, Three Point Capital, and Amber Group. [12]

Mantra CEO John Patrick Mullin said the fund will operate an “open-arms policy, welcoming projects at any developmental stage globally with a particular focus on RWA’s and DeFi.” Mullin told Cointelegraph:

“The MEF thesis is to invest in top-tier teams building RWA and DeFi applications, as well as complimentary infrastructure, that will both directly and indirectly support the broader ecosystem.”

OM's Collapse

The price of Mantra OM plunged over 90% on April 13, 2025, falling from around $6.30 to below $0.50 within hours. [14]

In an April 14 post on X, co-founder, JP Mullin said the sharp drop in OM’s price was caused by forced liquidations triggered by centralized exchanges. He explained that these actions were taken suddenly and during low-liquidity hours on Sunday evening UTC, which may have amplified the market impact. [14]

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders,” Mantra co-founder John Mullin wrote in an April 13 statement on X.

“The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice,” he added.

Mullin told an X user they believe one exchange “in particular” was to blame but said they were still “figuring out the details.” He told others that the centralized exchange in question wasn’t Binance. [15]

Some traders allege the token collapse was a rug pull, while others are speculating the Mantra team had used their tokens as collateral to take out a massive loan from a centralized exchange and the team fell prey to a loan risk parameter change, then a margin call.

Mullin denied these theories in follow-up X posts, saying, “The team did not have a loan outstanding” and haven't orchestrated a rug pull.

“Tokens remain locked and subject to the published vesting periods. OM’s tokenomics remain intact, as shared last week in our latest token report. Our token wallet addresses are online and visible,” Mullin said.

Mantra announces Token Burn

On April 21, 2025, MANTRA announced 150M token burns after unstaking period ends on April 29, 2025. [16]

Mantra

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]