Read

Edit

History

Notify

Share

OTSea

OTSea is a blockchain-based, peer-to-peer exchange platform designed for ERC-20 token holders to maximize their returns and access discount and private exchange opportunities. Launched in 2023, OTSea aims to provide an alternative avenue for trading cryptocurrencies by bypassing traditional liquidity pools and facilitating direct peer-to-peer transactions. [1] [3]

Overview

OTSea is a blockchain-based peer-to-peer exchange platform that facilitates direct trading of ERC-20 and SOL tokens without relying on liquidity pools. It enables users to execute trades without slippage or transaction taxes, using smart contracts as intermediaries.

The platform addresses trust issues in over-the-counter (OTC) trading by ensuring tokens are securely held in a smart contract until a buyer completes the transaction. This structure allows traders to exit positions without affecting market charts, providing an alternative to large-scale token sales that could otherwise disrupt price stability.

OTSea also enables bulk sales by distributing tokens among multiple buyers, reducing market impact. Bypassing liquidity pools eliminates buy/sell taxes imposed by some ERC-20 projects, allowing for direct user transactions. Additionally, it offers the flexibility to set custom prices for trades, facilitating discounts or promotions while maintaining profitability compared to selling through traditional exchanges. [2]

Features

Buy & Sell Orders

OTSea v1 supports buy and sell orders, allowing users to exchange tokens for the chain’s native currency or vice versa. Orders can be customized with various parameters to suit trading preferences.

A buy order offers the chain’s native currency to acquire tokens, while a sell order offers tokens in exchange for the native currency. Configurable fields include the amount of tokens being traded, the desired exchange amount, and adjustments relative to market prices on Uniswap. Additional options allow users to auto-match with existing orders, keep listings private, enable whitelisting, delay execution, or allow multiple buyers to fill an order through a crowd-funding mechanism. [7] [8]

Crowd-Fill Sales

Crowd-Fill Sales allow multiple users to purchase portions of an order rather than requiring a single buyer to complete the transaction. This feature is enabled by default, letting buyers select the amount they wish to purchase from a listed order. This approach allows token holders, including large sellers, to distribute their tokens through over-the-counter transactions, accommodating buyers of varying sizes. [8] [9]

Unlisted Orders

Unlisted Orders allow users to keep their listings off the platform’s browse page while making them accessible via direct links. These orders are not searchable within the dApp but remain visible on the blockchain. This feature is useful for users who want to share orders with a specific group without maintaining a whitelist or for those who prefer to trade with reduced visibility. [8] [10]

Arbitrage Bot Protection

Arbitrage Bot Protection helps prevent bots from exploiting price differences between OTC trades and Uniswap. These bots scan for orders, fill them, and immediately sell the tokens on Uniswap, counteracting the benefits of peer-to-peer trading by contributing to price dumps.

To address this, an optional delayed-release feature locks purchased tokens for five minutes before they become claimable. This delay reduces the effectiveness of arbitrage bots while still allowing legitimate trades. The delay can be configured when creating an order and may be enforced by partnered token projects for trades involving their tokens. [8] [11]

Auto-Match

Auto-Match searches for existing orders that meet or exceed a user's criteria and fills them before finalizing the new order. If matches are found, the system completes those trades first, and any remaining tokens are placed in a new order. For example, if a buyer attempts to purchase tokens at a set price, Auto-Match checks open orders and offers a better rate. If confirmed, the buyer receives more tokens than expected. Any unspent amount is then listed as a new order.

This feature is a hybrid order book that automatically presents users with matching orders at equal or better prices. When creating orders, users can choose whether to enable Auto-Match, which is available across all supported chains. [8]

Ecosystem

Mini Markets

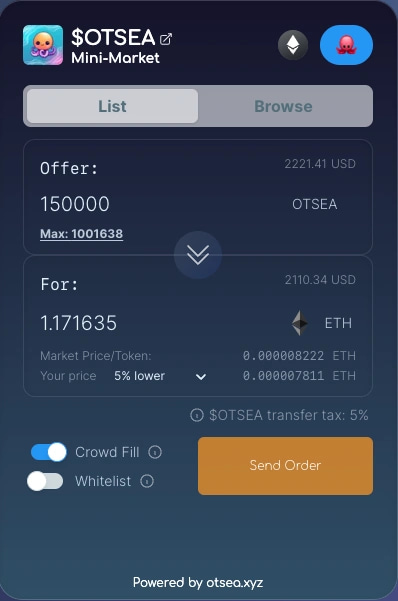

OTSea Mini-Markets provides projects with an embedded OTC marketplace, enabling peer-to-peer token trading directly on their website. This feature allows large holders to sell tokens without impacting market charts, offering discounts while avoiding slippage fees.

The Mini-Market widget integrates into a project’s website with minimal code. It exclusively displays OTC orders for the project’s token, filtering out other listings from OTSea. The embedded interface allows users to create, update, and fill orders, including crowd-fill and all-or-nothing transactions. [12]

Mini-Bot

OTSea Mini-Bot enables automated order streaming and transaction execution within Telegram. Connecting a standard wallet allows users to subscribe to specific tokens, receive order notifications, and fill orders directly from Telegram. The bot allows project channels and individual users to set up personalized order streams, follow specific tokens, and manage Mini-Markets. Commands include subscribing or unsubscribing from tokens, viewing subscribed tokens, and adding or removing Mini-Markets. To activate Mini-Bot, users add it to a Telegram channel or chat, subscribe to tokens, and manage trades seamlessly within the platform. [13] [14]

Shell

OTSea Shell is a token locker that enables the trading of locked tokens through Shell tokens, which mirror the underlying asset at a 1:1 ratio. Users can lock tokens for free, trade the locks, and place offers on existing locked assets.

When tokens are locked, an equivalent number of Shell tokens are minted to the owner's address. These tokens function as standard ERC-20 assets, allowing them to be transferred or traded. Once the lock period expires, the holder of the corresponding Shell tokens can redeem the locked tokens. [15]

Technology

The OTSea platform operates through the following process:

- Order Creation: A user initiates an order by specifying the token they wish to trade, the quantity, and the desired amount of ETH in exchange.2. Smart Contract Escrow: The tokens are temporarily held in a smart contract until the order is fulfilled3. Order Fulfillment: Other users can send ETH to purchase the tokens, receiving them immediately upon transaction completion.2. Order Settlement: The order creator can "Settle" the order at any time, withdrawing any remaining unfilled tokens and received ETH. [2] [3]

$OTSEA Token

The $OTSEA token serves as the native asset of the platform, with a total supply of 100 million. Holders receive 75% of platform revenue, while 25% is allocated to the team for development, operations, and marketing. Dividend distribution is based on market share, and a 5/5 transaction tax applies, with 20% of the tax contributing to revenue sharing.

Launched on September 16, 2023, $OTSEA provides reduced platform fees and dividend access. Holding at least 50,000 $OTSEA on Ethereum grants lower trading fees on EVM chains, incentivizing OTC trading to minimize market volatility. Holding at least 0.2% of the total supply further reduces platform fees. Since launch, 50% of platform and tax revenue has been burned. [4] [5]

Partnerships

- Palm AI

- Bitgert (Brise)

- Vertical AI

- Spectre

- Turan

- Base God

- OpenGPU

- AstraAI

- ARC

- Hege

- Cortensor

- Giko Cat

- Hold

- BCPI

- RDX

- Volumint

- Chainpal AI

- Bubsy AI

- KHAI

- Mind AI

- Morph AI

- QAAG AI

- KLAUS

- Synk

- Neura

- Three

- Neiro

- Andy

- Deepsouth AI

- Quby

- Dubcat

- Jester

- Myst

- Neuravox

- Xero AI

- BlockInsightAI

- Shezmu

- DefenderBot

- COK

- Tweet

- Stealth AI

- Tracker

- Fortify AI

- Boys Club

- Jeje

- AURK

- Ocean Fund

- CODE

- Moutai

- L2VE

- Virtu Network

- Dollar

- OG PEPE

- Neuralink

- NodelyAI

- BlackRock

- Build AI

- AIDev.bot

- Peblo

- Cryptify

- Sika

- Butterfly AI

- Sharky

- Brise

- NPI

- POOWEL

- Pecker

- Soldi

- Anon

- Moneta

- Rocco

- Dione

- BLK6900

- Brick Block

- Grass

- Antitoken

- Orbler

- CRTAIN

- Choruz

- Scotty AI

OTSea

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]