Read

Edit

History

Notify

Share

StakeWise

StakeWise is a decentralized platform that enables users to participate in liquid staking for Ethereum and Gnosis Chain. It leverages a community-driven approach through a DAO, allowing stakers to govern key protocol parameters for a seamless and efficient staking experience. [1]

Overview

StakeWise is a decentralized protocol that enables users to stake ETH and GNO while maintaining liquidity through liquid staking tokens, osETH, and osGNO. It features a staking marketplace where users can select node operators, reduce slashing risks, and stake independently. The protocol also allows individuals and organizations to create custom staking pools and issue liquid tokens to their users, supported by an ecosystem maintained by the StakeWise DAO. [8]

Features

Vaults

Vaults in StakeWise V3 are independent staking pools designed to securely manage ETH and GNO deposits, staking, reward distribution, and withdrawals through non-custodial smart contracts. Each Vault operates in isolation, meaning deposits are only used to run validators for that specific Vault, and any resulting rewards or penalties are limited to it. Vaults can be customized with individual fees, operator choices, and MEV strategies. [3]

ETH Vaults

When users stake ETH into a Vault, the contract aggregates deposits and activates a new validator for every 32 ETH collected. This process depends on the Beacon Chain’s deposit queue, which can lead to delays in validator activation, especially during periods of high network activity. Until activation, ETH does not earn rewards, which may lower the Vault's APY. Once validators are active, their rewards are pooled and automatically reinvested alongside new deposits to compound returns. ETH amounts under 32 that accumulate in the Vault are considered unbonded and do not earn rewards. A high share of unbonded ETH relative to the total staked amount can dilute APY, as rewards are distributed across both staked and unstaked balances. Unbonded ETH may also be used to fulfill osETH redemptions or liquidations.

For unstaking, unbonded ETH is prioritized to fulfill withdrawal requests. If the available unbonded ETH is insufficient, the Vault will initiate validator exits to release additional ETH. Because exiting validators takes time, users enter an exit queue and continue earning rewards until their ETH is withdrawn from staking. Once exited, users can claim their ETH at their convenience. [3]

GNO Vaults

In GNO Vaults, the staking mechanism mirrors ETH but with different validator requirements. A new validator is created for every 1 GNO staked. Like ETH, the activation of validators is delayed by the Gnosis Beacon Chain’s deposit queue, potentially affecting APY. Validator rewards are auto-compounded by combining them with new deposits to grow the Vault’s position over time. Deposits under 1 GNO are treated as unbonded and yield no rewards. When unbonded GNO forms a significant portion of the Vault, it can dilute APY, and StakeWise may use this GNO to process osGNO redemptions or liquidations.

For GNO unstaking, the Vault first uses unbonded GNO to meet requests. If insufficient, it allows validators to free up the required GNO, placing users into an exit queue. Unlike ETH, users in the GNO exit queue stop earning rewards immediately upon being queued. Users can withdraw their funds at any time. [3]

Minting osGNO

osGNO is a liquid staking token that represents GNO staked within StakeWise Vaults. It accumulates GNO rewards generated by the validators associated with each Vault, allowing users to maintain liquidity while their assets remain staked.

The ability to mint osGNO depends on the Vault’s loan-to-value (LTV) ratio. Most Vaults support minting up to 90% of the value of the staked GNO. However, certain Vaults approved by the StakeWise DAO are eligible for a higher minting threshold of up to 99.95%, provided they meet stricter performance and risk management standards. [3]

Minting osETH

osETH is a liquid staking token that represents ETH deposited in StakeWise Vaults. It accumulates ETH rewards earned by the validators associated with the Vault, allowing users to access liquidity without unstaking.

The ability to mint osETH depends on the Vault's loan-to-value (LTV) ratio. Most Vaults permit minting up to 90% of the value of their staked ETH. Certain Vaults approved by the StakeWise DAO can mint osETH up to a 99.99% threshold if they meet stricter performance and security requirements. [3]

Solo Vaults

Solo Vaults are customizable staking pools in which a single individual acts as both the node operator and the depositor of ETH or GNO. These Vaults can be either public or private and offer flexibility in setup.

Solo stakers can tailor their Vaults to fit specific preferences, including setting personalized fee levels, selecting how MEV is handled (via the Smoothing Pool or their own escrow), and opting out of token minting to avoid possible tax implications related to tokenized deposits or withdrawals. [3]

Governance

Each Vault operates as an independent staking pool, with its underlying smart contracts remaining immutable unless voluntarily upgraded. The StakeWise DAO may release updated versions of Vault contracts to improve security or efficiency. Still, individual Vaults are not required to adopt these changes, allowing them to maintain control over their specific staking configuration.

Vault governance is structured around several defined roles that manage different aspects of the staking process: Vault Admin, Access Manager, and Keys Manager. [3]

- The Vault Admin is responsible for deploying the Vault and setting foundational parameters, such as its type and associated fee. This role also manages Vault branding. A Vault Admin can be a wallet, a multisig, or a DAO, but the role cannot be reassigned after deployment. While the Vault Admin cannot modify the Vault’s core settings post-deployment, they can designate other roles and change the fee recipient address.

- The Access Manager controls the whitelist for Private Vaults by adding or removing allowed wallets. Initially, the Vault Admin holds this role but can assign it to another wallet and reclaim it later if needed.

- The Keys Manager is responsible for submitting the deposit data required to initiate new validators. Like the Access Manager role, this function is initially held by the Vault Admin but can be transferred and later reclaimed. StakeWise verifies all submitted deposit data to ensure it is valid, unique, and includes the correct withdrawal address.

Oracles

StakeWise V3 relies on a decentralized Oracle Network to manage validator registration, exits, and reward data collection from the Ethereum and Gnosis Beacon Chains. This system uses 12 Oracles operating under a 7-of-11 consensus model, ensuring that key actions, such as updating staking rewards or processing validator operations, require agreement from a majority. This helps prevent manipulation, centralized control, or regulatory interference.

Each Oracle is responsible for automatically retrieving reward data for all Vaults, submitting it on-chain, and managing validator activity based on deposit and withdrawal events. These tasks are executed through StakeWise-developed software and require no manual intervention. The Oracle Network is central in securing accurate rewards distribution and efficient staking operations across the protocol. [4]

osToken

In StakeWise V3, liquid staking is facilitated through osTokens, which are staked tokens that generate staking rewards while held. These tokens, such as osETH and osGNO, represent staked assets in the system and allow staked tokens' liquidity, allowing users to earn rewards while maintaining flexibility in their holdings. [2]

osETH

osETH is an ERC-20 liquid staking token representing ETH staked in Vaults, earning validator rewards and redeemable for ETH at an exchange rate determined by StakeWise Oracles. It can be minted against any Ethereum node, enabling permissionless, non-custodial staking, including solo staking and DeFi use. As rewards accrue, osETH’s value increases through a repricing mechanism reflected in its fair exchange rate and net APY. In 90% LTV Vaults, excess staked ETH protects holders against slashing and performance risks. In comparison, 99.99% LTV Vaults require operators to post a 5M SWISE bond to insulate other holders from Vault-specific issues and keep APY aligned with the lowest-yielding Vault. [2]

osGNO

osGNO is an ERC-20 liquid staking token representing GNO staked in Vaults, earning GNO rewards from validators and redeemable for GNO at an exchange rate determined by StakeWise Oracles. It can be minted against any Gnosis Chain node, enabling permissionless, non-custodial staking, including solo staking, and use in DeFi. The token's value increases through a repricing mechanism reflected in its fair exchange rate and net APY as rewards accrue. In 90% LTV Vaults, excess staked GNO protects against slashing and underperformance. In comparison, 99.95% LTV Vault operators must post a 1M SWISE bond to protect other holders, ensuring the token’s APY aligns with the lowest-yielding Vaults. [2]

StakeWise DAO

StakeWise DAO operates with a community-first approach, prioritizing feedback and adoption to ensure that staking is as seamless and profitable as possible. By placing protocol governance in the hands of stakers, the DAO aims to build a cohesive community where users' interests drive decision-making and protocol development.

The DAO governs key system parameters, including fees paid by stakers, commissions for node operators, the onboarding and offboarding of oracles and node operators, principles for liquidity mining campaigns, whitelisting gauge contracts, Insurance Fund payout triggers, and approval of contract changes for new features. The community's involvement in selecting these parameters is crucial, as it requires balancing both immediate interests and the protocol’s long-term success. [6]

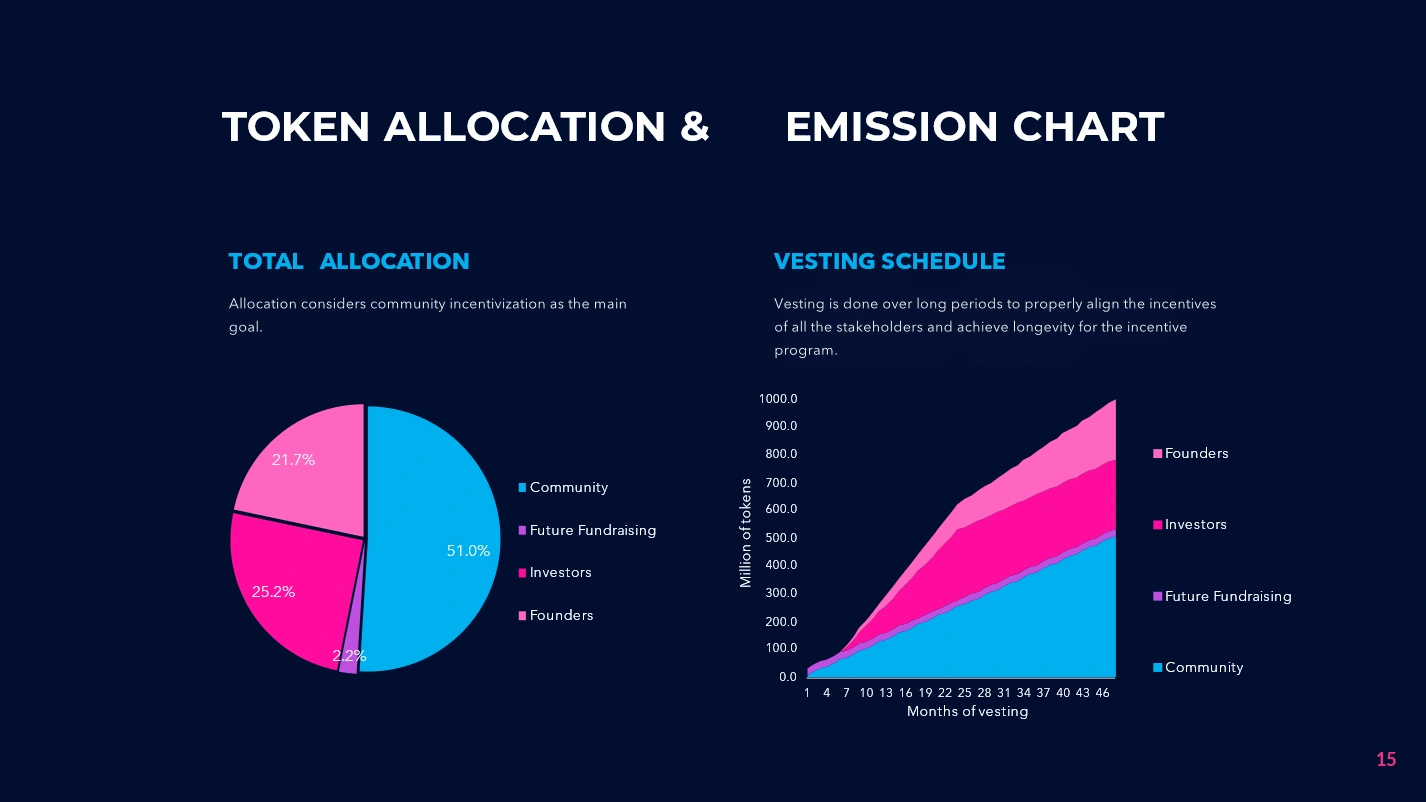

SWISE

$SWISE is the governance token of the StakeWise DAO. It has a total supply of 1B tokens with the following allocation: [6]

- Community: 510M

- Investors: 251.5M

- Team: 217M

- Future Fundraise: 21.5M

Partnerships

Blockscape

DSRV

Everstake

Finoa

Gateway.fm

HashQuark

Infstones

Meria

KysenPool

Launchnodes

Luganodes

NodeSet

MatrixedLink

PierTwo

Stake Fish

Stakely

Sensei Node

Serenita

Verilog

Chorus One

Beacon Chain

BlockShard

DataNexus

Brick Towers

CryptoManufaktur

StakeWise

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]