Read

Edit

History

Notify

Share

Synthswap

Synthswap is a decentralized exchange (DEX) built on the Base ecosystem, utilizing an automated market maker (AMM) model for trading and yield farming. It operates as a non-custodial protocol with low trading fees and a focus on user governance and efficient liquidity management. [1]

Overview

Synthswap is a decentralized exchange (DEX) within the Base ecosystem, utilizing an automated market maker (AMM) model. Using a non-custodial protocol, users can trade and engage in yield farming. Synthswap does not execute trades or offer clearing services directly but provides information about its protocol, ensuring users understand its operations and the broader ecosystem. [2][3]

The platform does not control or manage users' crypto assets and remains uninvolved in transactions. It also does not endorse third-party resources, maintaining a focus on decentralization. Key features include low trading fees, achieved through concentrated and active liquidity management, which optimizes efficiency and enhances rewards from staking and yield farming. [2][3]

Synthswap emphasizes community involvement through governance voting, allowing users to influence protocol changes. It offers a decentralized, user-centric experience focused on low fees, efficient liquidity, and community-driven governance while maintaining a purely informational role. [2][3]

Features

Concentrated Liquidity

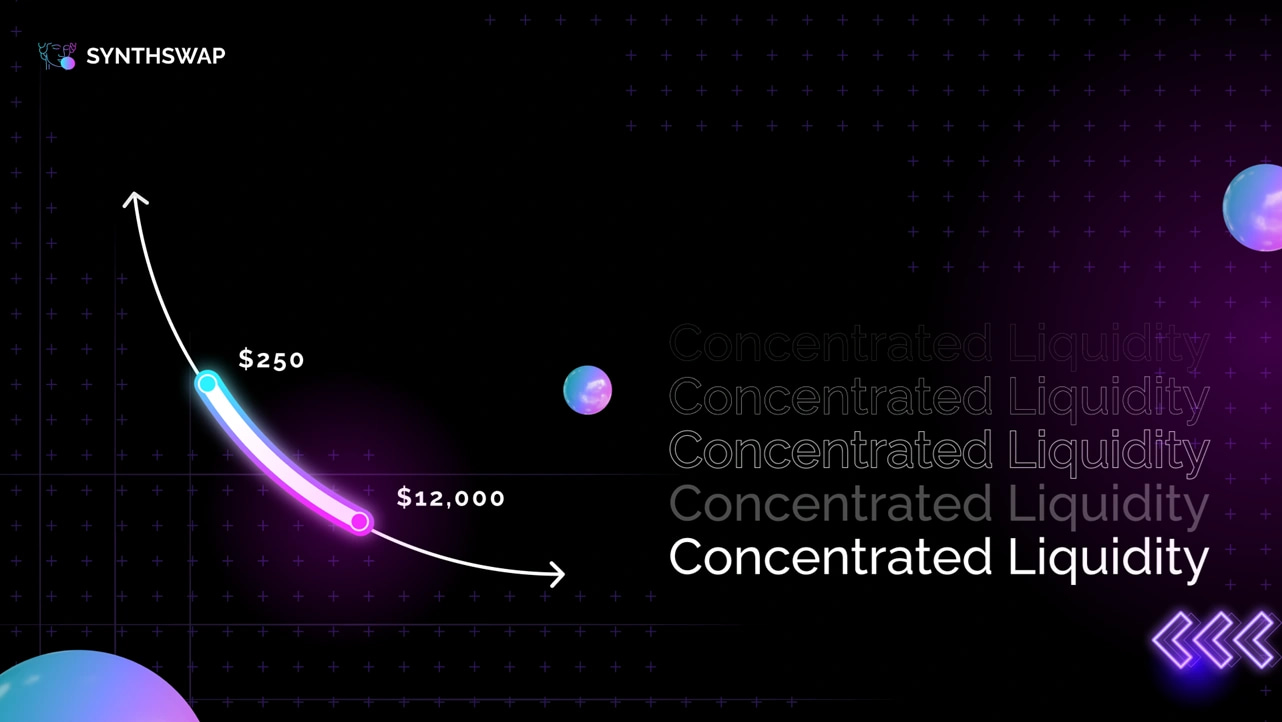

Concentrated liquidity allows liquidity providers (LPs) to allocate funds within a custom price range, optimizing capital efficiency and minimizing impermanent loss. Unlike earlier models like the XYK formula, where liquidity is spread across all price ranges, concentrated liquidity focuses funds within specific intervals. This ensures LPs earn higher trading fees when the price enters their designated range, as their liquidity is actively used in trades. This approach enhances fee generation, reduces slippage for traders, and allows LPs to tailor positions to their preferences, making liquidity management more efficient and profitable. [4]

Gamma

Active Liquidity Management (ALM) with Gamma automates liquidity rebalancing and fee compounding, optimizing user capital efficiency. Gamma is a non-custodial protocol that simplifies the management of concentrated liquidity pools by handling tasks like rebalancing and position setting, reducing the complexity of active liquidity management in decentralized finance. By automating these processes, Gamma mitigates the challenges of concentrated liquidity, such as impermanent loss and the need for constant supervision, while allowing for more composability through ERC-20 representations of liquidity positions. [5]

Futures

Futures contracts allow traders to speculate on the future value of cryptocurrencies without owning the underlying asset. Traders can profit from rising and falling markets, with long positions aiming to benefit from price increases and short positions from price decreases. On Synthswap, users can engage in futures trading with up to x50 leverage, allowing them to open long or short positions with either market or limit orders. The platform also supports swaps with no price impact, providing flexibility in managing trading strategies. The key risks include price movements against the trader's position, leading to potential losses. [6]

SYNTH

The SYNTH token, native to Synthswap, follows a fair launch model for distribution, aiming for decentralization and fairness. There are no initial allocations to the team or investors, and the token uses a fixed supply with linear emissions alongside deflationary mechanisms to reduce the overall supply over time. [7]

Tokenomics

SYNTH has a maximum supply of 250,000 tokens and has the following allocation: [7]

- Liquidity Incentives: 35%

- Core Contributors: 25%

- Development/Marketing: 20%

- Ecosystem/Partners: 15%

- Protocol Liquidity: 5%

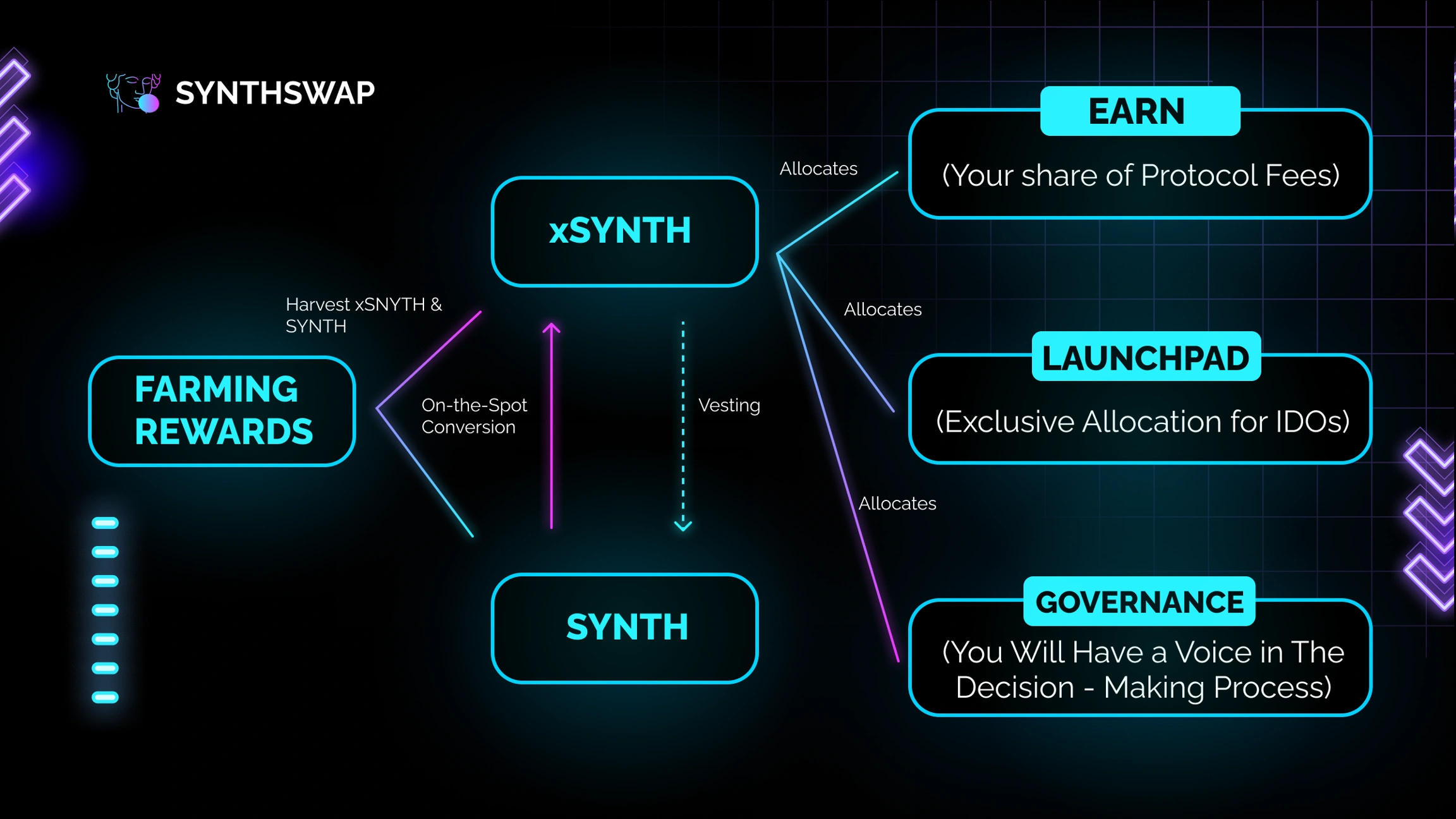

xSYNTH

xSYNTH is a non-transferable, escrowed token tied to the SYNTH protocol. It represents staked SYNTH and is used for profit-sharing, governance, and launchpad allocations. By staking xSYNTH, users can earn rewards, participate in protocol profits, and influence governance decisions. Rewards vary monthly, depending on the current cycle pair. Additionally, staking xSYNTH increases project allocation opportunities on the platform's launchpad. xSYNTH can be converted back to SYNTH after a vesting period, with full conversion possible after 180 days or partial conversion after 14 days, with the remaining SYNTH being burned. [8]

Partnerships

- Algebra

- Axelar

- PeckShield

- Rabby Wallet

- Firebird Finance

- Kado

- Yahoo! Finance

- Bloomberg

- Cointelegraph

Synthswap

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]