Read

Edit

History

Notify

Share

BNB

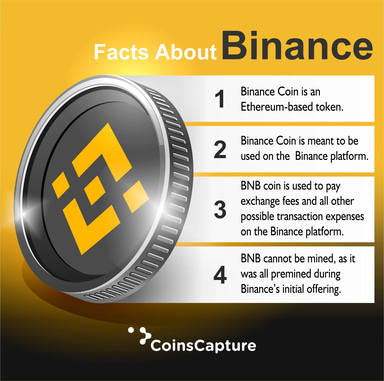

BNB is the cryptocurrency that powers the Binance ecosystem. BNB can be used for discounts across the Binance ecosystem as well as staking, governance, and settling transactions on BNB Chain. The token can also be used for payments and DeFi services. [9] BNB is regularly burned and removed from the token supply through quarterly burning events with BNB Auto-Burn. When BNB is used as gas for transactions on the BNB chain a portion of the BNB used as gas is burned. [25]

History

Binance originally created the tokens in order to raise capital through an initial coin offering (ICO). The coins were sold in the first week of the ICO in July 2017 at a price of 1 BNB for 15 cents each. Binance raised a total of $15 million in Bitcoin (BTC) and Ethereum (ETH) from this ICO. From the $15 million raised, 35% was utilized to upgrade the Binance platform and exchange system, 50% was used for Binance branding, marketing, and education of new innovators and the remaining 15% was set aside as a reserve in case of any emergencies or unusual circumstances.[10]

BNB was originally presented as an ERC-20 token on the Ethereum blockchain with a total supply of 200 million. In 2019, Binance started its mainnet swap and migrated all BNB tokens to BNB Chain. BNB Chain is composed of two blockchains, both powered by BNB:

- BNB Beacon Chain: Previously called Binance Chain, this blockchain handles BNB Chain governance functions such as voting and staking.

- BNB Smart Chain (BSC): Once known as the Binance Smart Chain, this blockchain uses the Ethereum Virtual Machine to support smart contracts and is fully compatible with Ethereum’s tools and decentralized apps (DApps).[25]

Utility

The original value proposition of the BNB token was that users of the Binance exchange could access discounts on spot, margin, and futures trading fees by paying using the tokens. BNB tokens can also be used as gas for settling transactions on BNB Chain, staking on the chain, and as a governance token for the chain, allowing holders to participate in some of the project’s decision-making. [9]

The token offers access to several Binance services including further discounts through the Binance VIP program, lending for token farming through Binance Launchpool, sending and receiving payments through Binance Pay, earning yield by depositing BNB on certain BNB Chain projects, earning referral fees through Binance's referral program, access to token sales on Binance Launchpad, crypto loans through Binance Loan, staking rewards through with the BNB Vault, making purchases with the Binance Visa Card, as well as making donations through Binance Charity. [27]

BNB is also accepted by several companies in the payment space including Pundi X, Monetha, HTC, Coinpayments, CoinGate, Coinify, and NOWPayments. It is also accepted by several travel, entertainment, service, and finance decentralized applications and companies. [27]

BNB Burning

There are two main ways in which BNB is burned and removed from the circulating supply. The first consists of quarterly BNB burning events. The second was introduced in the BEP-95 and involves burning a portion of the BNB spent as gas fees on the BNB Chain. [11]

The initial total supply of the token was 200,000,000 BNB, but it is gradually decreasing through coin burns and BEP-95. The burning events will happen until 50% of the total supply is destroyed, reducing it to under 100,000,000 BNB. However, the BEP-95 mechanism will continue to burn BNB. [11][23]

Previously, the quarterly BNB burns were based on the BNB trading volume on the Binance exchange. But in December 2021, Binance announced the new BNB Auto-Burn. The BNB Auto-Burn mechanism automatically adjusts the amount of BNB to be burned based on the BNB price and the number of blocks generated on the BNB Chain during each quarter. This offers greater transparency and predictability to the BNB community. [23]

BNB Auto-Burn

In December 2021, the Binance team announced that the quarterly burn would be replaced with BNB Auto-Burn to provide greater transparency and predictability to the BNB Community. BNB Auto-Burn will be independent of revenues generated on the Binance CEX through the use of BNB and will be automatically adjusted in that the burn amount will be based on the price of BNB, which, in turn, reflects the supply and demand for BNB, as well as the number of blocks produced during a quarter calculated on the basis of on-chain information. Once the total circulating supply of BNB falls below 100 million, the BNB Auto-Burn stops. [23]

Binance implemented its first-ever BNB auto-burn program (18th burn) in December 2021, removing over 1.6 million BNB tokens worth $750 million from circulation.[24]

On October 2022, Binance completed its 21st quarterly burn of BNB tokens automatically and took 2,065,152.42 BNB off the market.[14]

BEP-95

In 2021, Binance's former CEO CZ shared a plan to accelerate BNB burns as the overall burning rate was slower than he originally anticipated. [29] To accelerate the process, Binance introduced a new burning mechanism through the BEP-95 in November 2021. [11]

BEP-95 is a Binance Evolution Proposal that adds a real-time burning mechanism to the BNB Chain. The smart contract automatically burns a portion of the gas fees collected by validators from each block. As more people use the BNB Chain, more BNB will be burned, speeding up the burning process. [28]

As BEP-95 is solely dependent on the BNB Chain network, unlike BNB Auto-Burn, it will continue to burn BNB after the 100 million burn target has been reached.

BNB Pioneer Burn Program

Binance also has a program called the BNB Pioneer Burn Program. In eligible cases, users who lose tokens may be able to put them towards the official "burn" count and get reimbursed with new BNB. Eligible cases include mistakes concerning tokens worth more than $1,000 but less than the planned "burn" volume.[9]

BNB Mainnet Swap

After the mainnet launch of Binance Chain, users were encouraged to migrate from the Ethereum blockchain to the Binance Chain. Therefore, ERC-20 BNB token holders started to replace their tokens with the newly issued BEP2 BNB coin (the native coin of Binance Chain). The mainnet swap followed a 1:1 ratio so that 1 ERC-20 BNB had the same value as 1 BEP2 BNB. After the swap, all remaining ERC-20 BNB tokens were burned, so now only the BNB of the new chain can be used.[11][12]

Binance also allowed users to leave their previously issued tokens on their accounts, so the platform could automatically swap their tokens with native tokens.[13]

On April 23, 2019, Changpeng Zhao announced via Twitter, that BNB tokens were successfully migrated to the Binance Chain. He stated:

Just burned 5mm ERC20 BNB, commencing swap to the real #BNB.[9]

BNB Hack

On October 6, 2022, transactions on the BNB Chain were halted after a potential exploit in the network was detected through a spike in "irregular activity." The initial announcement was posted to Twitter by BNB Chain at 9:19 pm EDT, saying there would be a temporary pause on the BSC network. By 9:35 pm EDT, the network pause turned into a halt.[15][16] They further tweeted:

To confirm, we have suspended BSC after having determined a potential exploit. All systems are now contained, and we are immediately investigating the potential vulnerability. We know the Community will assist and help freeze any transfers. All funds are safe.[17]

According to blockchain security firm SlowMist, the hackers managed to steal over $570 million in crypto, including Ethereum, Polygon, BNB Chain, Avalanche, Fantom, Arbitrum, and Optimism.[18]

By 10:20 pm EDT, BNB Chain said that $7 million in assets had been frozen before it could be transferred but acknowledged that between $70 million and $80 million were stolen from the Binance Smart Chain:

Initial estimates for funds taken off BSC are between $70M - $80M. However, thanks to the community and our internal and external security partners, an estimated $7M has already been frozen.[19]

Binance former CEO Changpeng Zhao later posted an update pointing to a thread on Reddit where the company provided more technical details and said that "the current impact estimate is around $100m USD equivalent."[16][20]

Binance's Response

On October 7, 2022, BNB Chain released its first official statement thanking the community for its support during the incident, along with the next steps for ensuring future network security. In the statement, the BNB Chain Team owned up to the exploit and apologized to users. They also expressed gratitude to how quickly the issue was identified and resolved by the community:

UPDATE: Official BNB Chain Response. We're humbled by the support, hard work, and dedication from the community of which we are proud to be a part.[21][22]

In addition to official numbers related to the incident, the BNB Chain highlighted its next steps to ensure future network security against potential exploits: an on-chain governance vote would decide what to do with hacked funds, whether they should be frozen or not, and if BNB Auto-Burn should be implemented to cover the remaining exploited funds. The community would also vote on a bounty for catching hackers and a white-hat program for future bugs found which could be $1 million for each.[21]

BNB

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

[25]

[26]

[27]

[28]

[29]