Read

Edit

History

Notify

Share

StakeWise Staked ETH (osETH)

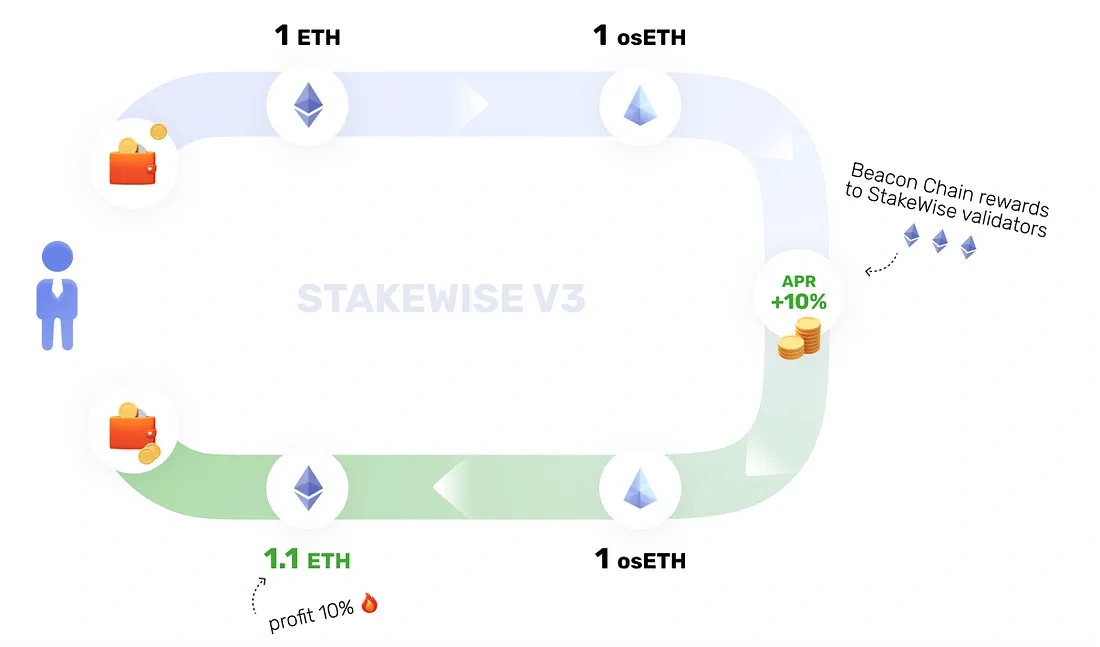

StakeWise Staked ETH (osETH) is a liquid staking token representing ETH deposited in StakeWise Vaults, earning validator rewards. It can be minted against any Ethereum node, offering non-custodial, permissionless access to staking. The token is overcollateralized to ensure accurate decentralized exchange pricing and protect holders from slashing risks. Users can mint osETH to access liquidity, use it in DeFi, and redeem it for ETH when available. [1] [3]

Overview

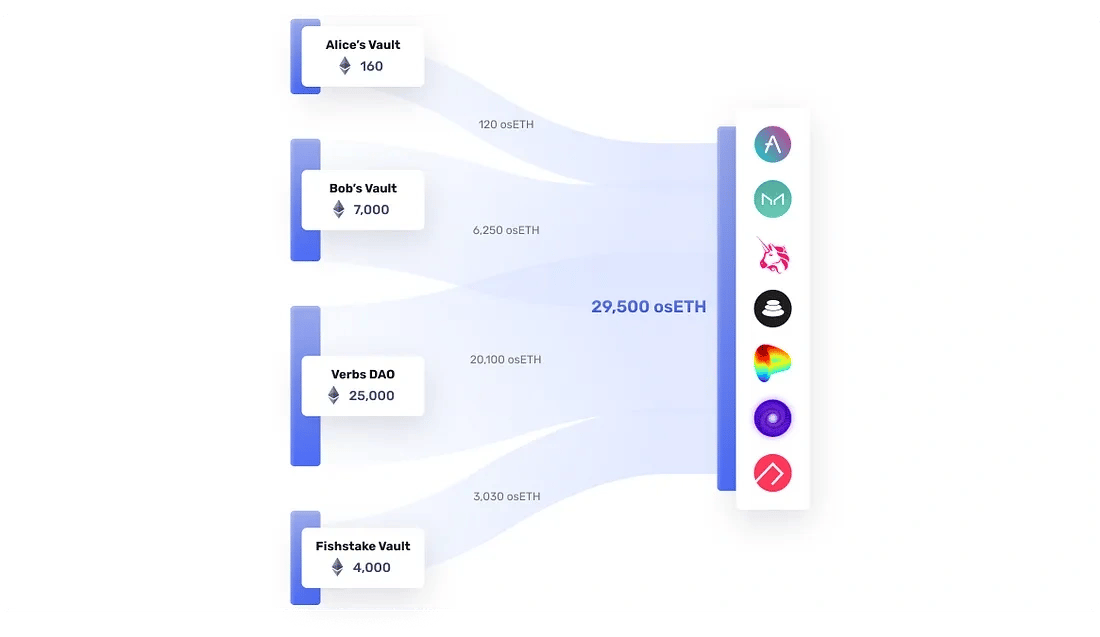

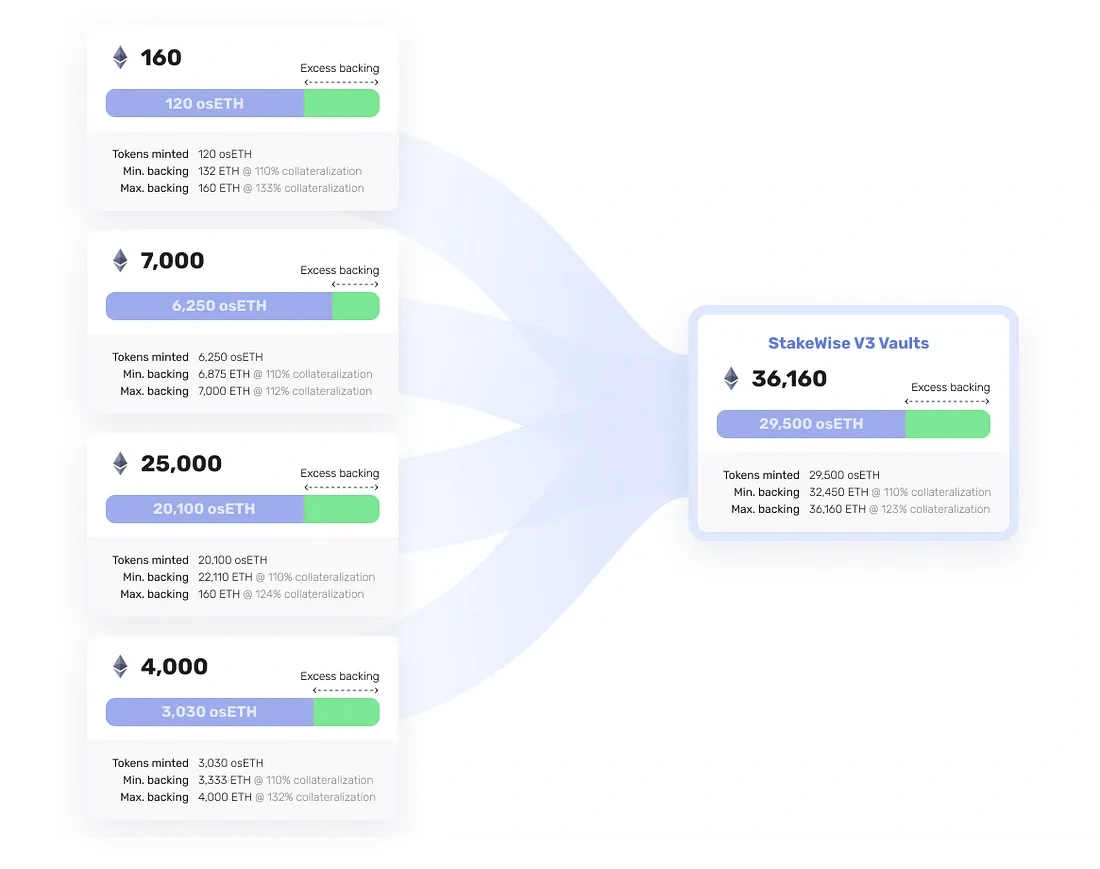

osETH is a liquid staking token representing ETH staked in Vaults and earning rewards from validators. It can be minted against any Ethereum node, offering permissionless and non-custodial access to staking, including solo staking, and can be used in DeFi. The token’s value increases over time as staking rewards accumulate, reflected in its fair exchange rate and APY, net of StakeWise DAO fees. osETH is redeemable for ETH at an exchange rate determined by StakeWise Oracles, with instant redemptions when enough unbonded ETH is available and validator exits initiated if needed. Buyers of osETH on decentralized exchanges are insulated from individual Vault risks, while excess staked ETH protects 90% LTV Vaults, and 99.99% LTV Vaults require a 5M SWISE bond from operators to shield other holders from slashing and performance issues. [2] [5]

Utility

osETH provides utility by enabling users to unlock liquidity from staked ETH while maintaining control of their assets. It can be minted against ETH staked in Vaults and used across DeFi applications such as trading, lending, and farming. As staking rewards accrue, the token’s exchange rate increases, capturing yield. Overcollateralization protects holders from slashing risks, and osETH can be redeemed for ETH through the protocol or on secondary markets. Solo stakers and node operators can also mint osETH, supporting decentralized and permissionless access to liquid staking. [1] [4]

Minting

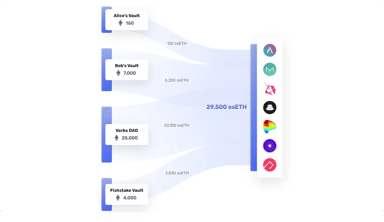

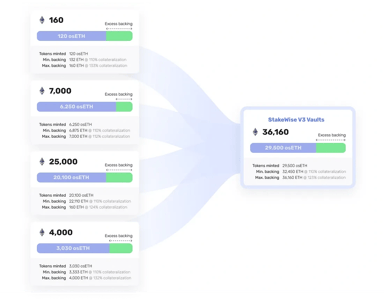

osETH is minted by staking ETH in Vaults, allowing users to convert a portion of their stake into a liquid token backed by staked ETH in validators. The amount of osETH that can be minted depends on the value of the staked ETH, the current osETH exchange rate, and the collateralization rules set by the StakeWise DAO. Minting requires excess backing to mitigate risks—either through overcollateralization in 90% LTV Vaults, where up to 90% of the ETH stake can be made liquid, or a SWISE bond in 99.99% LTV Vaults, where up to 99.99% of the stake is eligible. In both cases, ETH rewards continue to accrue on the full staked amount, but only a portion is made liquid as osETH. [2]

Burning

To unstake ETH from a Vault, users must burn the osETH they previously minted, which involves returning the token to the protocol so the associated staked ETH can be unlocked. The required burn amount includes the originally minted osETH plus a 5% fee on any rewards it accrued, set by the StakeWise DAO. Fully burning osETH is necessary to fully exit a position; partial burns result in partial withdrawals, as the position must remain within the health thresholds defined for each Vault type (up to 90% for 90% LTV Vaults and up to 99.99% for 99.99% LTV Vaults). This ensures all osETH remains appropriately backed by staked ETH. [2]

StakeWise Staked ETH (osETH)

Feedback

Did you find this article interesting?

Twitter Timeline

Loading

Media

REFERENCES

[1]

[2]

[3]

[4]

[5]